-

Buying a life insurance policy, if you haven’t yet, is one of the things you want to cross out on your list of “life goals.”

We have all grown up understanding that life or health insurance provides a sense of security. That is why comedian, showbiz reporter, and actor Ogie Diaz invested in several life insurance policies.

In one of his YouTube episodes, Ogie shows his viewers a drawer filled with folders that contain the policies of each member of his family. He had championed owning life insurances over properties because, unlike the latter, he says, there is no need for the immediate family to pay estate taxes upon the death of a policy-holder. He adds you can use the insurance to pay for estate taxes.

What is VUL?

However, despite investing in several insurance policies, Ogie felt he didn’t get his money’s worth when he availed of an insurance policy with a Php200,000 sum assured and Variable Universal Life component (VUL) in 2013.

After paying a Php42,000 premium per year for eight years, Ogie wondered why his fund value is only at Php201,000 when, in fact, he has paid a total of Php344,000.

Financial literacy and microfinance expert Vince Rapisura then reached out to Ogie through his YouTube channel Usapang Pera to discuss the comedian’s experience.“VUL ay insurance na may kasamang investment,” says Rapisura. “May kasamang fund value kung saan nakalagay ang investment portion ng VUL.”

When you pay the premium of your policy yearly, a portion of that payment is invested in accounts that can grow your money, like stocks. However, Rapisura says insurance agents don’t often discuss where the rest of the money goes with potential clients.

ADVERTISEMENT – CONTINUE READING BELOWRapisura says that a significant percentage of the premiums go to different charges such as:

- insurance charges

- policy fee

- annual management fee

- agent’s commission

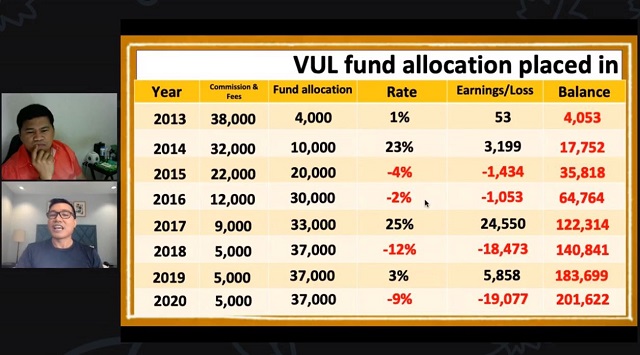

To show Ogie where his money went in the last eight years and why his earnings only amounted to Php201,000, Rapisura made him a graph.

Rapisura factored in commissions and fees, rate fluctuations in the market, and Ogie’s earning/loss based on the years’ rate fluctuations, and how much his policy earned per year.PHOTO BY Facebook/vincerapisuraCharges are the culprit

“Nangunguna sa commission ang insurance company,” Rapisura tells Ogie. “Literally, tayong mga clients and bumubuhay sa company nila. Maliit ang pinapasok (nila) sa investment.”

He adds that when VUL projections are being explained to clients, agents often base them on an average historical growth rate, usually positive. “It does not take into account dips in the market.”

Rapisura advised that it is more practical to buy “term insurance” that offers pure life protection and no cash value is involved, and premiums are cheaper.

CONTINUE READING BELOWRecommended VideosIn fact, Rapisura says, a premium for a Php200,000 sum assured Term Insurance policy only costs Php1,200 – Php2,000 per year, a far cry from the Php42,000/year Ogie has paid for his policy with investment. Moreover, term Insurance is also offered by the same companies that have policies with VUL.

Make your money grow through Buy Term Invest the Difference (BTID) strategy

“Hindi pinaghahalo ang insurance at investment,” Rapisura stresses. A better move yet, he says, is to follow the Buy Term Invest the Difference (BTID) strategy.

“BTID ay isang strategy para masulit ang pera sa pagbili ng insurance at pag-iinvest,” he defines.

Rapisura adds it is not a product but something that individuals can do on their own for their money to grow while at the same time avoiding high fees and commissions imposed by insurance companies.

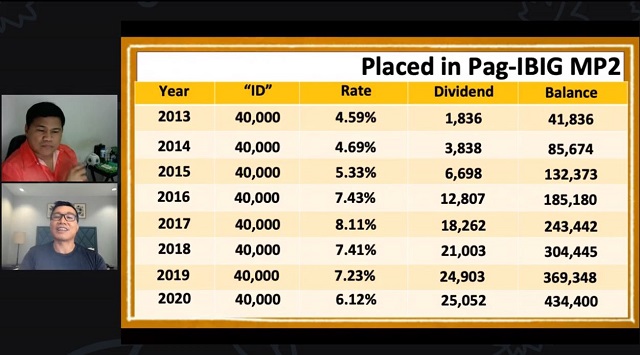

Using the same premium Ogie paid for his insurance policy with VUL for eight years, Rapisura showed him how much his Php42,000 per year can earn using the BTID strategy if it went to a savings program like PAG-IBIG’s MP2 or Modified PAG-IBIG 2.

Rapisura gives these factors:

- Budget for BTID = Php 42,000

- Term Insurance = 2,000 (BT or Buy Term)

- For Investment = 40,000 (“ID” or Invest the difference)

Based on the graph, if Ogie got Term Insurance instead, he would have only paid Php2,000 per year.PHOTO BY Facebook/vincerapisuraADVERTISEMENT – CONTINUE READING BELOWOgie could have invested as much as Php40,000 per year on a saving program like MP2, which would give him an average 5.5% growth yearly. But, instead, by using the BTID strategy, the same money earned him Php233,000 more.

Once this was explained to him, Ogie says he plans to talk with the companies he has bought insurance policies from to better understand where his money is going.

Getting An Insurance Policy? If You Hear VUL, This Financial Expert Has A Tip

admin

September 15, 2021

Tags:

You may like these posts

Popular Posts

Daily Morning Awesomeness (25 Pictures)

April 16, 2025

11-Year-Old Genius Wants To Create Technology To Prevent Humans From Dying

September 14, 2021

India is not for beginners

January 16, 2024

Random Posts

3/random/post-list

Recent in Sports

3/recent/post-list

Popular Posts

Daily Morning Awesomeness (25 Pictures)

April 16, 2025

11-Year-Old Genius Wants To Create Technology To Prevent Humans From Dying

September 14, 2021

India is not for beginners

January 16, 2024

Menu Footer Widget

Crafted with by TemplatesYard | Distributed By Free Blogger Templates

0 Comments